Create a Mortgage Loan Application Form.

Create a Mortgage Loan Application Form.

Create a Mortgage Loan Application Form.

The mortgage application form cannot have any loose ends because of the high loan costs. Are you making it right? Time for a quick recall.

The mortgage application form cannot have any loose ends because of the high loan costs. Are you making it right? Time for a quick recall.

The mortgage application form cannot have any loose ends because of the high loan costs. Are you making it right? Time for a quick recall.

Creating loan application forms in the banking and finance sectors is extremely important to fetch accurate data quickly. A mortgage loan application form is the entry point for prospective homeowners. To briefly recall, a mortgage loan is used to purchase or maintain a home, plot of land, or other real estate types.

Sections of a Mortgage Loan Application Form

One major issue is that the complexity of a mortgage loan application could deter a potential customer from applying for it. But this can be solved. How? Having the following sections in the form makes the layout educative and engaging.

Personal Identification

The initial section establishes trust and identity by collecting the applicant's full name, contact information, Social Security numbers, and marital status. Since people apply for mortgage loans online, having these details auto-filled will make the form-filling process smoother in this section.

Property Details

This section asks about the desired property's description: address, category (house, shop, land), type (single-family, apartment, commercial building), and purchase price.

Consider pre-populated fields for common property types and categories and offer dropdown menus to pick relevant options.

Loan Specifications

Here, the applicant has to share their financial objective. Ask them about the total sum of the mortgage loan and the type of loan (fixed-rate, adjustable-rate, etc.), show the loan terms, and determine their preferred terms. Educate the applicant about your institution’s terms and benefits to ensure the mortgage loan application form is filled by the end.

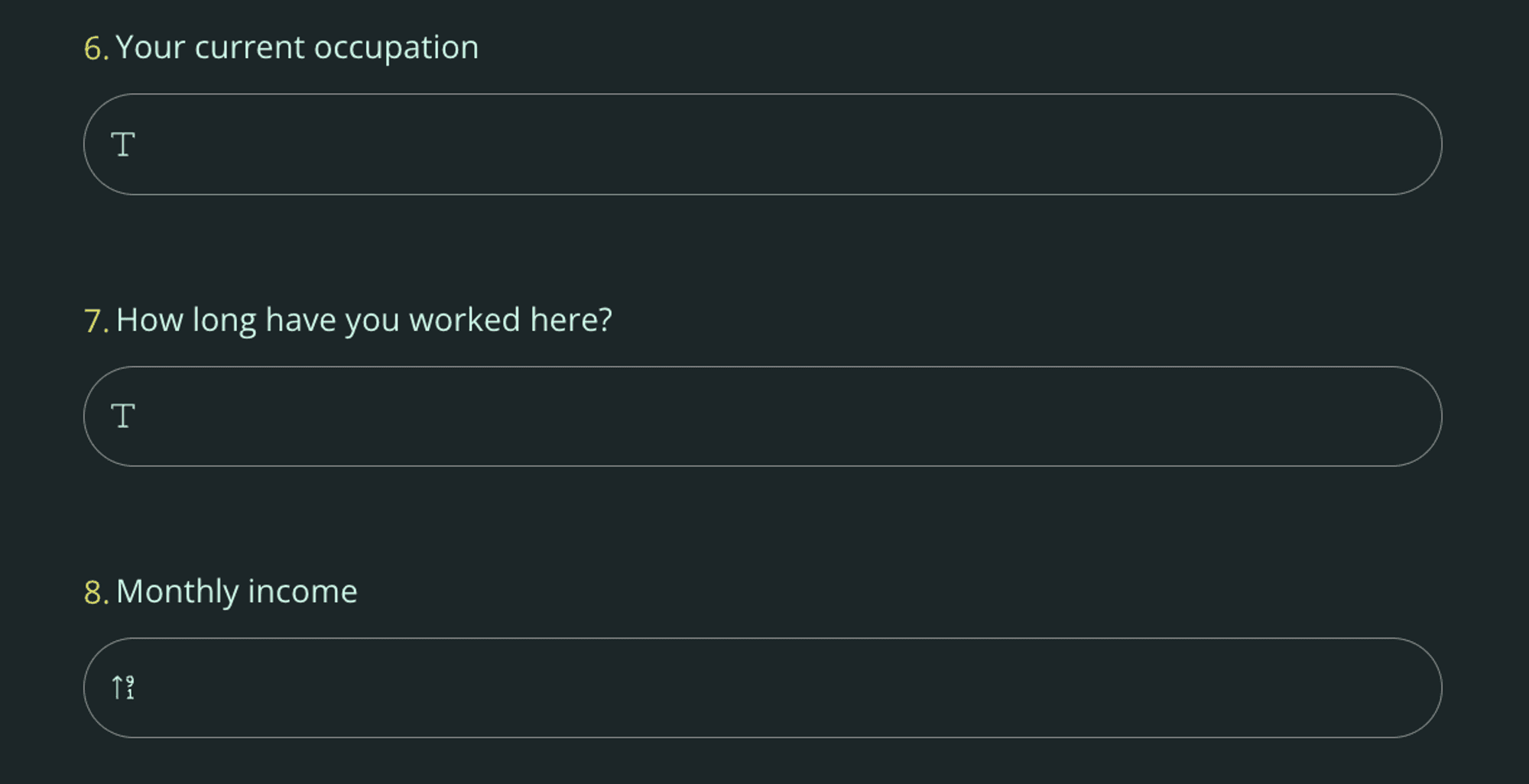

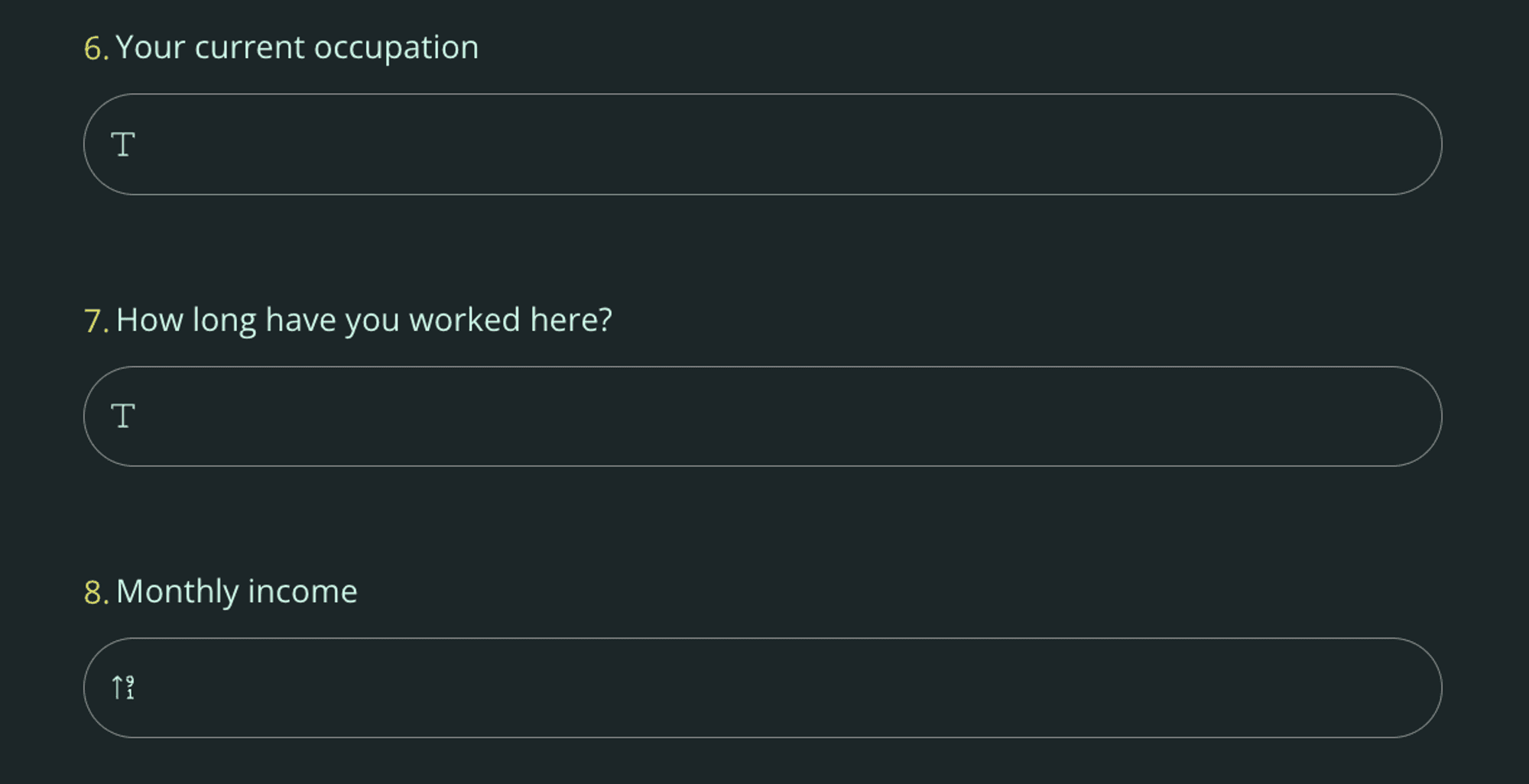

Employment Information

Since the amount for a mortgage loan is huge, knowing who will pay it back on time is essential. Hence, this section evaluates the applicant's income and stability more than other bank loan applications.

The questions are about current and previous employment details, including job titles, companies, duration of employment, and income calculated per year. It is best to be honest about these details; it goes without saying.

Financial Overview

Since people have more than one source of income, assets, and liabilities, a mortgage loan application form checks for that. The applicant discloses their assets (savings, investments, other real estate, vehicle) and liabilities (existing loans, credit card debts). Use clear labels to avoid confusion between asset and liability categories. Have enough space for the applicant to disclose other relevant information.

Integrity Declaration

Transparency is crucial in a loan application form. So, ask the applicant about the accuracy of pending loans, bankruptcy filings, foreclosures, and lawsuits. Offer them a definition for each parameter so that there’s no loss of context and the applicant makes an informed choice when signing up for the mortgage loan and agreeing to the integrity declaration.

Consent Section

Despite what the applicant has disclosed about the finances and income, a financial institution still needs to access an applicant’s financial history. This is why asking for consent and signature at the end of the mortgage loan application form is crucial. Tell the applicant what they consent to so there is no conflict later on.

Keep a Top-Notch User Experience

A well-designed form is not just about data collection. Here are a few user experience tips to keep in mind.

Validation and error prevention: Use real-time validation for different input types to spot errors and ask the user to enter data in the valid format. Plus, when you have clean data, this saves a lot of time later during data analysis.

Conditional logic and dynamic fields: Customize the mortgage loan application form to the applicant's response. If the applicant has opted for the house, only then show them options for the types of houses. Hide irrelevant sections and dynamically adjust field options based on the previous response.

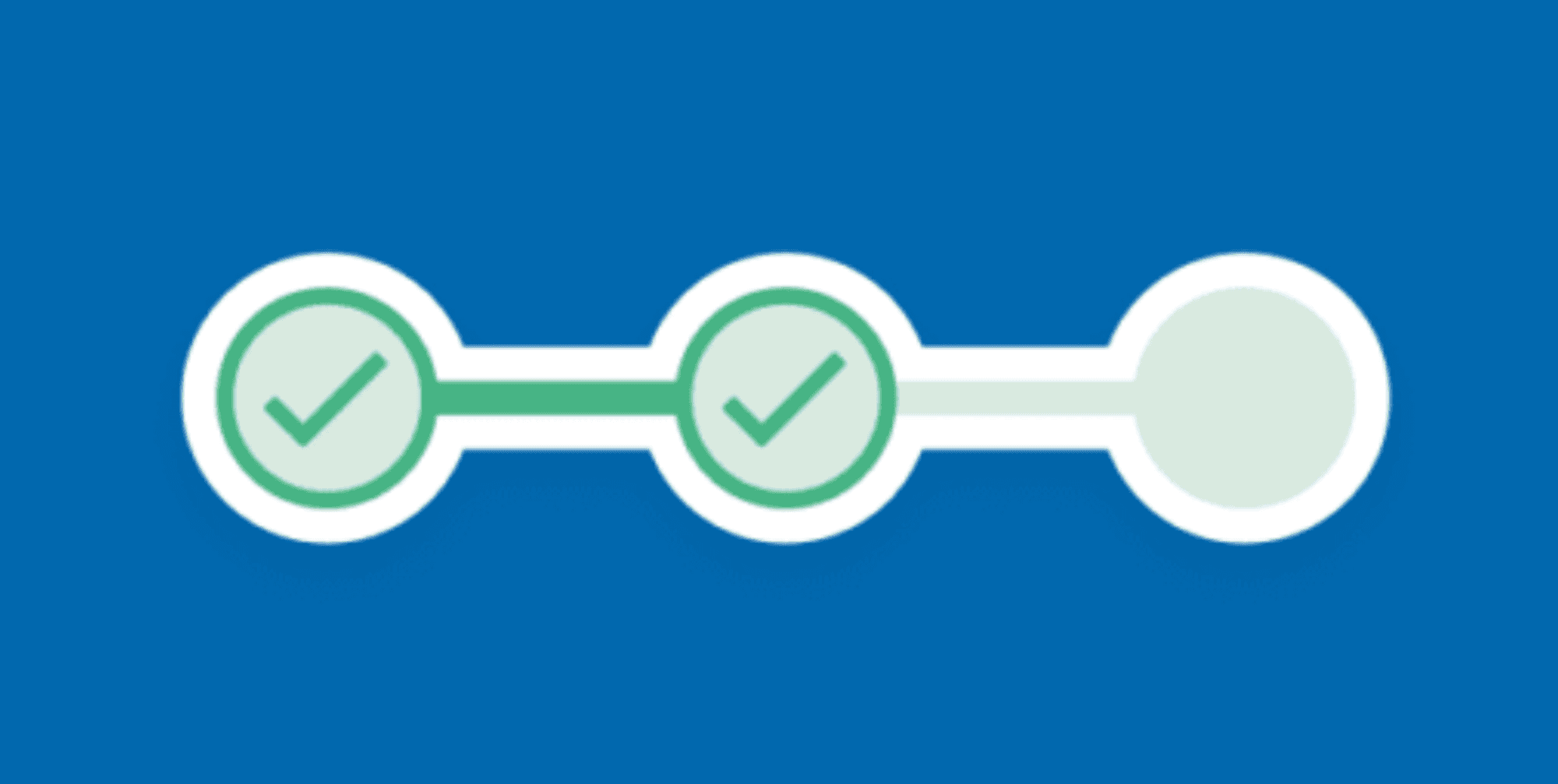

Progress indicators and completion time estimates: A progress bar informs the applicants of how far they have come. At the same time, rewarding them for completing a section motivates them to move ahead and reach the end.

Multiple access points and device compatibility: Build a mortgage loan application form that is compatible with all devices. Also, have a document parsing feature to retrieve information from an applicant’s official documents, such as a passport or residence proof.

Conclusion: Keep It Simple and Fast

In summary, an effectively designed mortgage loan application form can jumpstart a smooth loan processing experience. Therefore, remember to have relevant sections and a user experience that helps the applicant move to the “submit” button as quickly as possible.

The loan amount involved in a mortgage loan application form is high, so ensure that accurate information is collected. It might also be useful to have a few qualifying questions to filter through applicants who might not be financially capable or credible enough to repay the loan.

If you want to create a mortgage loan application form with higher conversion rates than other forms, try WorkHack. Get started for free today!

Creating loan application forms in the banking and finance sectors is extremely important to fetch accurate data quickly. A mortgage loan application form is the entry point for prospective homeowners. To briefly recall, a mortgage loan is used to purchase or maintain a home, plot of land, or other real estate types.

Sections of a Mortgage Loan Application Form

One major issue is that the complexity of a mortgage loan application could deter a potential customer from applying for it. But this can be solved. How? Having the following sections in the form makes the layout educative and engaging.

Personal Identification

The initial section establishes trust and identity by collecting the applicant's full name, contact information, Social Security numbers, and marital status. Since people apply for mortgage loans online, having these details auto-filled will make the form-filling process smoother in this section.

Property Details

This section asks about the desired property's description: address, category (house, shop, land), type (single-family, apartment, commercial building), and purchase price.

Consider pre-populated fields for common property types and categories and offer dropdown menus to pick relevant options.

Loan Specifications

Here, the applicant has to share their financial objective. Ask them about the total sum of the mortgage loan and the type of loan (fixed-rate, adjustable-rate, etc.), show the loan terms, and determine their preferred terms. Educate the applicant about your institution’s terms and benefits to ensure the mortgage loan application form is filled by the end.

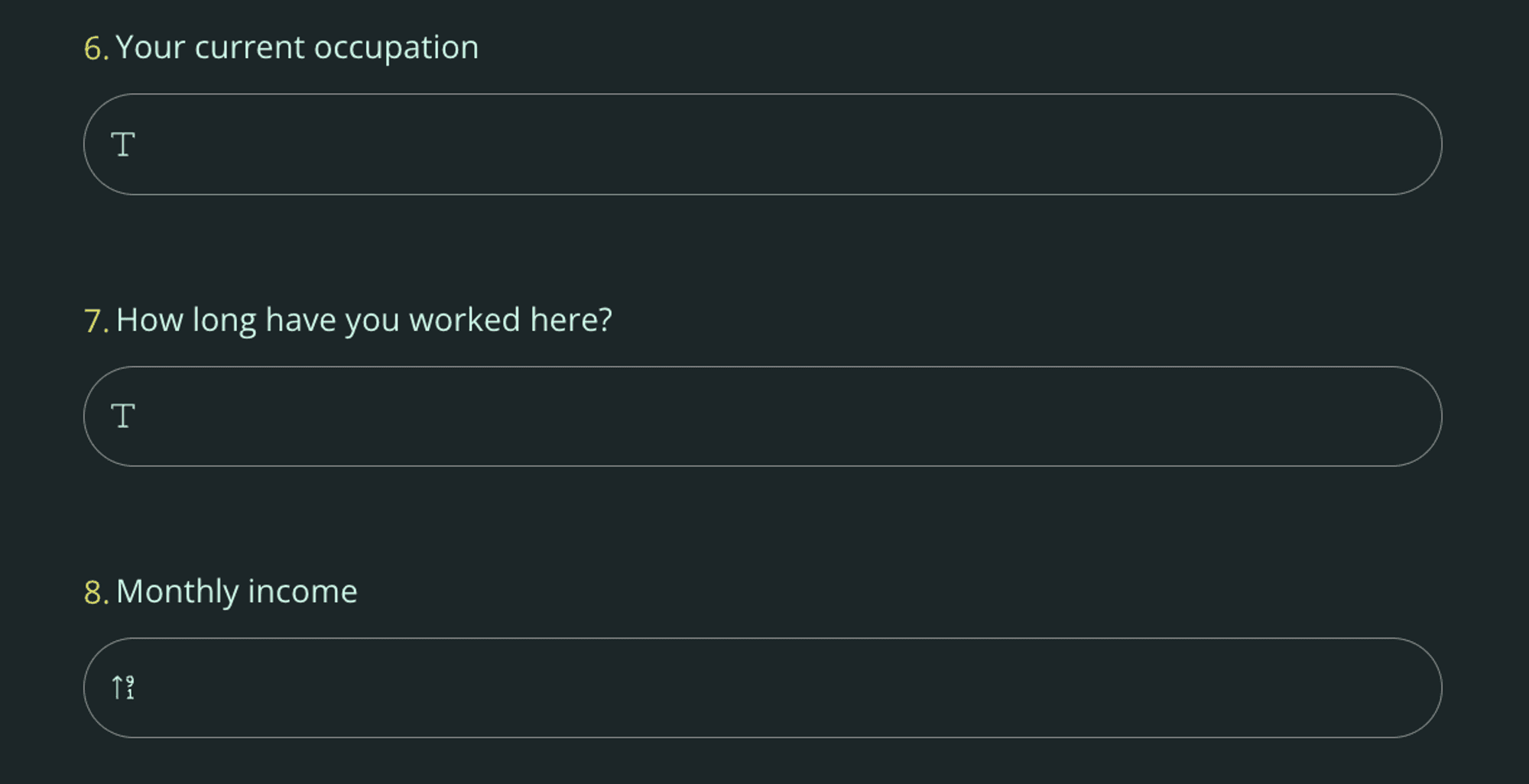

Employment Information

Since the amount for a mortgage loan is huge, knowing who will pay it back on time is essential. Hence, this section evaluates the applicant's income and stability more than other bank loan applications.

The questions are about current and previous employment details, including job titles, companies, duration of employment, and income calculated per year. It is best to be honest about these details; it goes without saying.

Financial Overview

Since people have more than one source of income, assets, and liabilities, a mortgage loan application form checks for that. The applicant discloses their assets (savings, investments, other real estate, vehicle) and liabilities (existing loans, credit card debts). Use clear labels to avoid confusion between asset and liability categories. Have enough space for the applicant to disclose other relevant information.

Integrity Declaration

Transparency is crucial in a loan application form. So, ask the applicant about the accuracy of pending loans, bankruptcy filings, foreclosures, and lawsuits. Offer them a definition for each parameter so that there’s no loss of context and the applicant makes an informed choice when signing up for the mortgage loan and agreeing to the integrity declaration.

Consent Section

Despite what the applicant has disclosed about the finances and income, a financial institution still needs to access an applicant’s financial history. This is why asking for consent and signature at the end of the mortgage loan application form is crucial. Tell the applicant what they consent to so there is no conflict later on.

Keep a Top-Notch User Experience

A well-designed form is not just about data collection. Here are a few user experience tips to keep in mind.

Validation and error prevention: Use real-time validation for different input types to spot errors and ask the user to enter data in the valid format. Plus, when you have clean data, this saves a lot of time later during data analysis.

Conditional logic and dynamic fields: Customize the mortgage loan application form to the applicant's response. If the applicant has opted for the house, only then show them options for the types of houses. Hide irrelevant sections and dynamically adjust field options based on the previous response.

Progress indicators and completion time estimates: A progress bar informs the applicants of how far they have come. At the same time, rewarding them for completing a section motivates them to move ahead and reach the end.

Multiple access points and device compatibility: Build a mortgage loan application form that is compatible with all devices. Also, have a document parsing feature to retrieve information from an applicant’s official documents, such as a passport or residence proof.

Conclusion: Keep It Simple and Fast

In summary, an effectively designed mortgage loan application form can jumpstart a smooth loan processing experience. Therefore, remember to have relevant sections and a user experience that helps the applicant move to the “submit” button as quickly as possible.

The loan amount involved in a mortgage loan application form is high, so ensure that accurate information is collected. It might also be useful to have a few qualifying questions to filter through applicants who might not be financially capable or credible enough to repay the loan.

If you want to create a mortgage loan application form with higher conversion rates than other forms, try WorkHack. Get started for free today!

Creating loan application forms in the banking and finance sectors is extremely important to fetch accurate data quickly. A mortgage loan application form is the entry point for prospective homeowners. To briefly recall, a mortgage loan is used to purchase or maintain a home, plot of land, or other real estate types.

Sections of a Mortgage Loan Application Form

One major issue is that the complexity of a mortgage loan application could deter a potential customer from applying for it. But this can be solved. How? Having the following sections in the form makes the layout educative and engaging.

Personal Identification

The initial section establishes trust and identity by collecting the applicant's full name, contact information, Social Security numbers, and marital status. Since people apply for mortgage loans online, having these details auto-filled will make the form-filling process smoother in this section.

Property Details

This section asks about the desired property's description: address, category (house, shop, land), type (single-family, apartment, commercial building), and purchase price.

Consider pre-populated fields for common property types and categories and offer dropdown menus to pick relevant options.

Loan Specifications

Here, the applicant has to share their financial objective. Ask them about the total sum of the mortgage loan and the type of loan (fixed-rate, adjustable-rate, etc.), show the loan terms, and determine their preferred terms. Educate the applicant about your institution’s terms and benefits to ensure the mortgage loan application form is filled by the end.

Employment Information

Since the amount for a mortgage loan is huge, knowing who will pay it back on time is essential. Hence, this section evaluates the applicant's income and stability more than other bank loan applications.

The questions are about current and previous employment details, including job titles, companies, duration of employment, and income calculated per year. It is best to be honest about these details; it goes without saying.

Financial Overview

Since people have more than one source of income, assets, and liabilities, a mortgage loan application form checks for that. The applicant discloses their assets (savings, investments, other real estate, vehicle) and liabilities (existing loans, credit card debts). Use clear labels to avoid confusion between asset and liability categories. Have enough space for the applicant to disclose other relevant information.

Integrity Declaration

Transparency is crucial in a loan application form. So, ask the applicant about the accuracy of pending loans, bankruptcy filings, foreclosures, and lawsuits. Offer them a definition for each parameter so that there’s no loss of context and the applicant makes an informed choice when signing up for the mortgage loan and agreeing to the integrity declaration.

Consent Section

Despite what the applicant has disclosed about the finances and income, a financial institution still needs to access an applicant’s financial history. This is why asking for consent and signature at the end of the mortgage loan application form is crucial. Tell the applicant what they consent to so there is no conflict later on.

Keep a Top-Notch User Experience

A well-designed form is not just about data collection. Here are a few user experience tips to keep in mind.

Validation and error prevention: Use real-time validation for different input types to spot errors and ask the user to enter data in the valid format. Plus, when you have clean data, this saves a lot of time later during data analysis.

Conditional logic and dynamic fields: Customize the mortgage loan application form to the applicant's response. If the applicant has opted for the house, only then show them options for the types of houses. Hide irrelevant sections and dynamically adjust field options based on the previous response.

Progress indicators and completion time estimates: A progress bar informs the applicants of how far they have come. At the same time, rewarding them for completing a section motivates them to move ahead and reach the end.

Multiple access points and device compatibility: Build a mortgage loan application form that is compatible with all devices. Also, have a document parsing feature to retrieve information from an applicant’s official documents, such as a passport or residence proof.

Conclusion: Keep It Simple and Fast

In summary, an effectively designed mortgage loan application form can jumpstart a smooth loan processing experience. Therefore, remember to have relevant sections and a user experience that helps the applicant move to the “submit” button as quickly as possible.

The loan amount involved in a mortgage loan application form is high, so ensure that accurate information is collected. It might also be useful to have a few qualifying questions to filter through applicants who might not be financially capable or credible enough to repay the loan.

If you want to create a mortgage loan application form with higher conversion rates than other forms, try WorkHack. Get started for free today!

5 Types of Loan Application Forms.

A loan application form is how you collect accurate and detailed information about a loan applicant. But which form has which sections? Let’s go deeper.

Create a Mortgage Loan Application Form.

The mortgage application form cannot have any loose ends because of the high loan costs. Are you making it right? Time for a quick recall.

Make an Easy to Fill Personal Loan Form.

Making a personal loan form is simple once you know the main sections and how to make an applicant quickly fill them out. Explore more in this blog.

Build The Best Credit Card Authorization Form.

One of the most frequently used finance forms is the credit card authorization form. But it is still being made as if we’re in the 1990s. Let's do it better.

KYC Form: What, Why and How?

KYC is an important step in the finance domain. But what does it mean to know your customer, and what are KYC requirements? Let’s find out.

5 Types of Loan Application Forms.

A loan application form is how you collect accurate and detailed information about a loan applicant. But which form has which sections? Let’s go deeper.

Create a Mortgage Loan Application Form.

The mortgage application form cannot have any loose ends because of the high loan costs. Are you making it right? Time for a quick recall.

Make an Easy to Fill Personal Loan Form.

Making a personal loan form is simple once you know the main sections and how to make an applicant quickly fill them out. Explore more in this blog.

Build The Best Credit Card Authorization Form.

One of the most frequently used finance forms is the credit card authorization form. But it is still being made as if we’re in the 1990s. Let's do it better.

KYC Form: What, Why and How?

KYC is an important step in the finance domain. But what does it mean to know your customer, and what are KYC requirements? Let’s find out.

5 Types of Loan Application Forms.

A loan application form is how you collect accurate and detailed information about a loan applicant. But which form has which sections? Let’s go deeper.

Create a Mortgage Loan Application Form.

The mortgage application form cannot have any loose ends because of the high loan costs. Are you making it right? Time for a quick recall.

Make an Easy to Fill Personal Loan Form.

Making a personal loan form is simple once you know the main sections and how to make an applicant quickly fill them out. Explore more in this blog.

Build The Best Credit Card Authorization Form.

One of the most frequently used finance forms is the credit card authorization form. But it is still being made as if we’re in the 1990s. Let's do it better.

KYC Form: What, Why and How?

KYC is an important step in the finance domain. But what does it mean to know your customer, and what are KYC requirements? Let’s find out.

Nine Types of Healthcare and Medical Forms.

Medical forms are a must-have for any healthcare business or practitioner. Learn about the different kinds of medical and healthcare forms.

4 Tips for Better Medical History Forms.

Medical history forms are central to patient care, onboarding, and medical administration records. Learn how to make them easier to fill.

How to Build Mental Health Intake Forms?

Mental health intake forms are not like patient intake forms. Mental health intake forms deal with far more sensitive data and have specific design methods.

What, Why and How of Telemedicine Forms.

Telemedicine is on the rise and with different form builders out there, which one best suits your needs as a healthcare services provider?

3 Reasons for Major Drop-Offs in Medical Forms.

No matter which healthcare form we pick, there are major drop-off reasons. We shall dive into the top 3 and learn how to resolve them in your next form.

Patient Onboarding Forms - From Click to Clinic.

Patient onboarding forms are the first touchpoint for patients; getting this right for higher conversion rates is a must-have. Learn how to perfect them now.

5 Key Parts of a Good Patient Satisfaction Form.

The goal of patient satisfaction surveys is to course-correct the services of a healthcare provider. Patient feedback leads to a culture of patient-centric care.

Build Quick and Easy Medical Release Forms.

Every HIPAA-compliant healthcare provider comes across medical release forms that involve details from medical history forms. Can they be shipped fast? Yes.

5 Types of Loan Application Forms.

A loan application form is how you collect accurate and detailed information about a loan applicant. But which form has which sections? Let’s go deeper.

Create a Mortgage Loan Application Form.

The mortgage application form cannot have any loose ends because of the high loan costs. Are you making it right? Time for a quick recall.

Make an Easy to Fill Personal Loan Form.

Making a personal loan form is simple once you know the main sections and how to make an applicant quickly fill them out. Explore more in this blog.

Build The Best Credit Card Authorization Form.

One of the most frequently used finance forms is the credit card authorization form. But it is still being made as if we’re in the 1990s. Let's do it better.

KYC Form: What, Why and How?

KYC is an important step in the finance domain. But what does it mean to know your customer, and what are KYC requirements? Let’s find out.

Subscribe to stay updated.

Subscribe to stay updated.

Subscribe to stay updated.

HC

HC

HC

HC

70+ people from across industries read our emails.

HC

HC

70+ people from across industries read our emails.

HC

HC

HC

70+ people from across industries read our emails.

Bangalore, India / San Francisco, US

WorkHack Inc. 2023

Bangalore, India

San Francisco, US

WorkHack Inc. 2023

WorkHack Inc. 2023

Bangalore, India / San Francisco, US

WorkHack Inc. 2023

Bangalore, India / San Francisco, US